Only $38, No upsells or hidden fees.

Money Back Satisfaction Guaranteed

Real Estate Appraisal &

Property Tax Appeal Course

40% - 60% Plus Nationwide Property Tax Over-Assessment Definitely Exists.

Paying An Over-Assessed U.S. Home Property Tax = Lost Money

Create A Professional Real Estate Appraisal, A to Z Made Easy, Step-By-Step Low Cost Course that Nails Your Home Real Valuation Without Hiring a Real Estate Appraiser and/or Attorney

Complete Course $38. Click Here:

Remove being at the mercy of a hastily done property tax assessment.

Blanket town reappraisals are sent out on a bid basis. The low cost bidder wins.

Consider the time and work involved for assessing the valuation price for a home. The average real estate appraisal in the U.S. for a single family home costs about $300 to $425. It takes comparative analysis with similar recently sold homes to arrive at a realistic market value. We supply ALL the info you need to get that job done accurately and quickly.

The real estate appraisal broker who won that blanket municipal appraisal needs to make a profit on top of paying his helpers. Plus he needs interaction time for organizing that data and communication . The time allocated per appraisal will be limited.

A thorough analysis, comparing your home to other similar homes is takes focus. Sold homes market comparisons are not done by the tax assessor so it is impossible to accurately arrive at true market valuation by a blanket appraisers team.

Because these assessments can't be done thoroughly due to time constraints, one should investigate to determine if they have a property tax appeal worth pursuing.

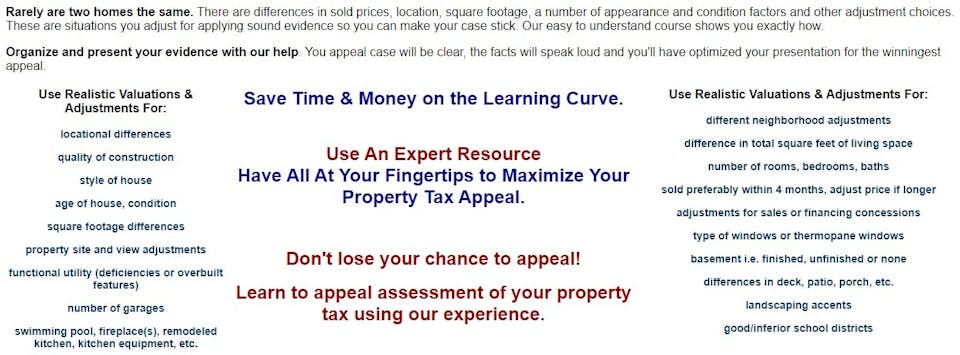

If you are serious about appealing your property taxes, you'll want a definitive guide. Property Values and Accurate Tax Adjustment Valuations will walk you through the process for differences in square footage, age of comparables, location or anything that one comparable has and the other lacks; such as location, square footage, quality, view, number of baths, rooms, garages, decks and over 20 other adjustment categories. You can employ with authentic backup valuation evidence in order to Win your Real Estate Property Tax Reduction Appeal.

This exact property valuation resource will help you deliver a compelling written appeal with the right adjustments and necessary elements that make sense to the Tax Assessor as well as to the Municipal Court of Appeals. You'll have authentic supportive evidence that will have an extremely high chance for winning your appeal.

People who appeal over-assessed property taxes realize great savings (maybe most importantly) that over the years, those tax savings stick and build into a serious lump of continuing cash savings (example: a typical 20% reduction, say $1,000/yr. property tax savings on a home = $10,000 savings over the next ten years)

Use our Property Tax Appraisal and Property Tax Appeal Course for property tax reduction. Because my experience as a real estate appraiser and property tax consulting with top real estate appraisers and valuation experts, I reveal all the tricks of the trade. This valuable Property Tax Appeal Course will drastically increase your chance for a winning appeal.

With a nationwide over-assessment and error rate hovering in the 40% -60% range, use this information to appeal. What happens will be impressive.

Get our resources now so you can be closer to having a lower property tax. Take action with our course to stand out with the best evidence in a property tax appeal that you can win.

No upsells or hidden fees.

Money Back Satisfaction Guaranteed

As certified real estate appraisers, we want you to WIN your Property Tax Appeal!

DIY House Appraisal Valuation: Create A Conclusive Property Valuation To See If It Lines Up With Your Property Tax Assessment

Home Valuation: Verify Real Estate Value & Discover if you have a Valid & Winnable Property Tax Appeal.

Then use our step-by-step course to champion your appeal.

Is something wrong with your property tax? Investigate. Then send the signal to the assessor and make the appeal!

For a successful tax appeal process, use our tax appeal workbook course. This works!

Use this comprehensive, logical itemized approach employing actionable advice! This real estate tax reduction course is intuitive and easy to apply for you to use every adjustment possible to appeal for a lower assessment.